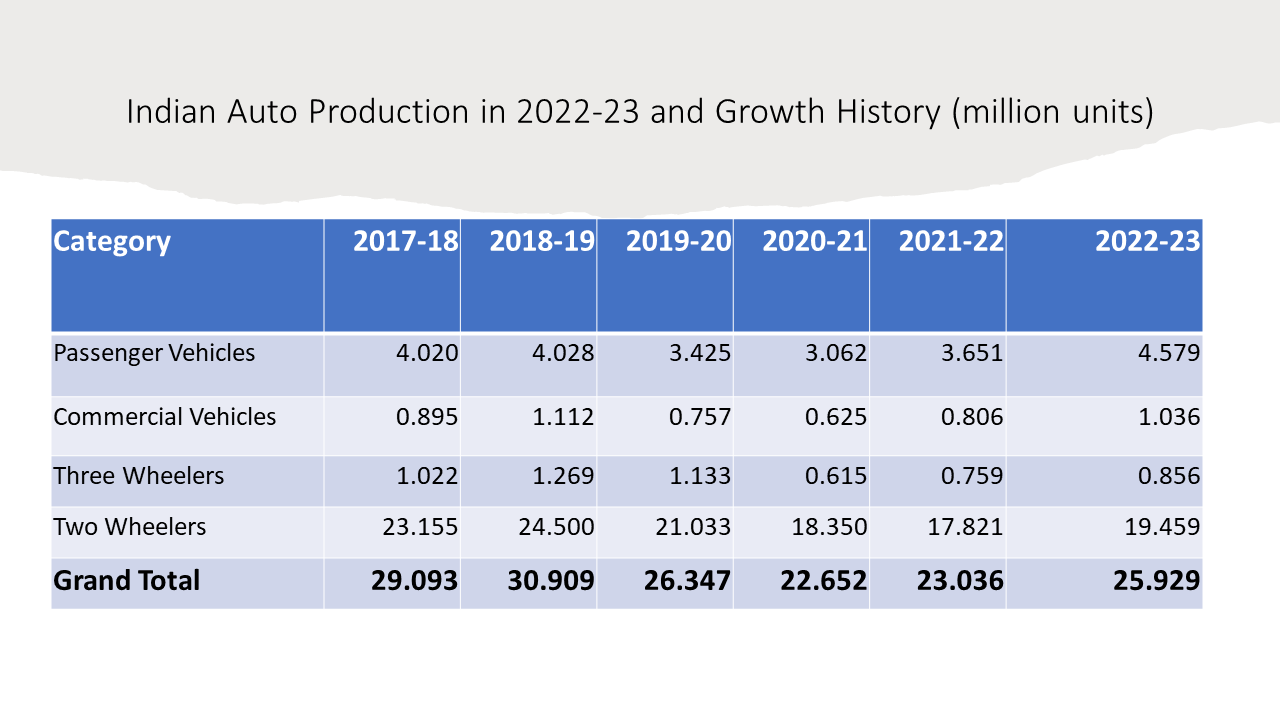

PRODUCTION

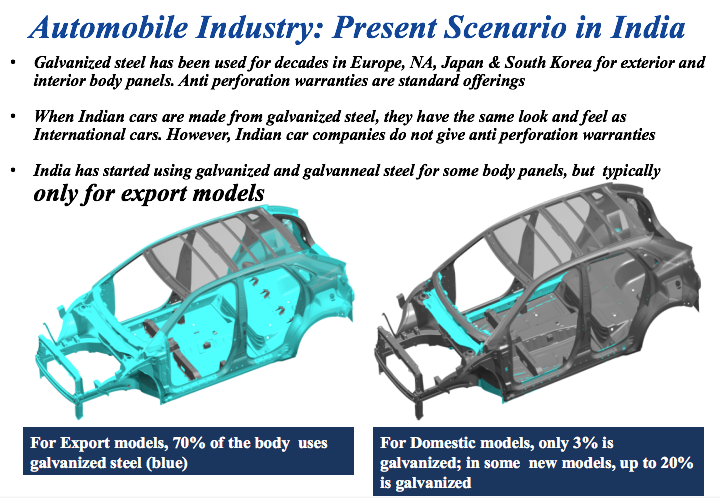

India is currently the fifth largest producer of passenger cars after China, Japan, the United States, Germany, and South Korea. In the next year or two, India is expected to overtake South Korea and Germany and become the fourth largest global producer of cars. India is also the second largest producer of two-wheelers and buses, and number three in heavy trucks. However, despite this growing global reputation, many Indian car buyers do not benefit from the corrosion warranties typical in Western economies, mainly because only a small amount of galvanized steel is used in the manufacture of cars in India.

IZA plans to change this through a three-pronged approach of:

1) educating consumers and automotive journalists on the important role of galvanized steel in protecting cars from corrosion,

2) technology transfer efforts to enable domestic steel manufacturers to build supply capacity for automotive exposed quality galvanized steel sheet for outer body panels,

3) and working with domestic automakers to share product and process knowledge and experience of the many benefits of adopting galvanized, high-strength steels.

INITIATIVES

In 2016, IZA commissioned a parking lot study which showed that galvanized cars exhibit significantly improved performance as compared to non-galvanized cars of the same model and year. The results were communicated to auto journalists throughout four regional, well-attended press conferences. Two of the largest suppliers of automotive steel sheet in India, Tata Steel and POSCO, have joined IZA’s Galvanized Autobody Partnership program. IZA is also planning several technology workshops incoming year with Tata, Jindal Steel and others.

BEYOND

These activities have begun to reap benefits. Maruti Suzuki, India’s largest automaker with over 45% market share, has announced it will adopt galvanized steel for a significant portion of its body and structural steels and it is expected that the remaining automakers in India will follow suit. If the market expansion curve witnessed in recent years continues, and the intensity of zinc use rises to Western levels (10 -11 kg zinc per car), then India’s automotive sector will eventually consume an estimated 150,000 TPY of zinc every year.

CASE STUDY

Corrosion Performance Survey of Cars Manufactured in India